Shares of Adani Wilmar hit a new high of Rs 299.65 in intraday trade on Wednesday after rising nearly 13 percent on the BSE.

Following today’s rally, shares of Adani Group’s edible oil major have surged 30% from its IPO price of Rs 230 per share and more than 36% above its BSE listing price of Rs 221. On the NSE, it is listed at Rs 227 with a slight drop of 1 per cent.

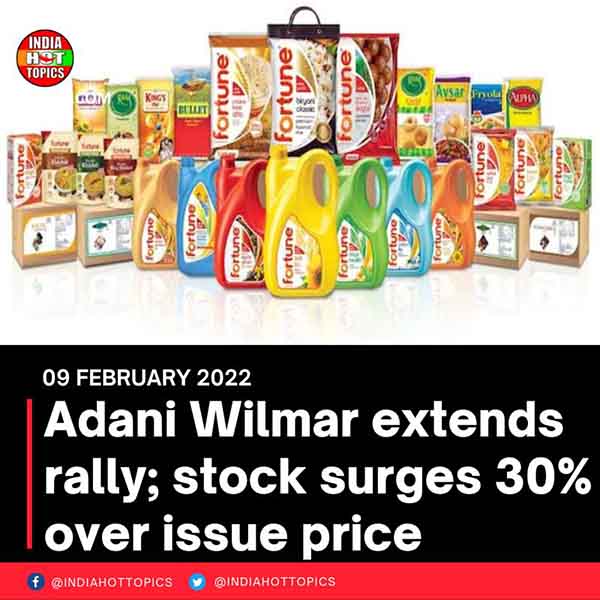

Adani Wilmar is the seventh public company of the Adani Group. The company, a joint venture between Adani Group and Wilmar Group, is India’s leading manufacturer of Fortune branded edible oils. In addition to oils, the company offers products such as wheat flour, rice, beans, sugar and packaged foods.

Proceeds from the public offering will be used to fund capital expenditures, reduce debt and make acquisitions as the company seeks to become India’s largest food and FMCG company.

The company is one of the few major FMCG companies to enjoy pan-India coverage, and its vast distribution network consists of 5,566 distributors across 28 Indian states and 8 federal territories, serving more than 1.6 million retail outlets .

“Adani Wilmar has benefited from its in-depth knowledge of the local market, extensive domestic trade experience and advanced logistics network. The company has successfully developed its ‘Fortune’ brand in the edible oil category and is a leader in the food sector.” Past 20 years,” ICICI Securities said in a report.

Separately, Adani Wilmar has notified the company’s board of directors that a meeting is scheduled for February 14, 2022 to review and approve the unaudited financial results for the quarter and nine months ended December 31, 2021.

Complete News Source : Business Standard