Business

Elon Musk owns 9.2 percent of Twitter as a ‘passive’ stakeholder. What does this imply?

SSC Exam Calendar 2025

SSC Exam Calendar 2025 revised, check CGL, CHSL, SI in Delhi Police, MTS, JE and other exam dates here

-

%20(2).jpg)

%20(2).jpg) Celebrity Lifestyle1 month ago

Celebrity Lifestyle1 month agoKareena Kapoor reveals her new schedule; says she has dinner at 6pm, lights out at 9:30 pm: ‘Saif, the kids and me, we’re all cooking together’

-

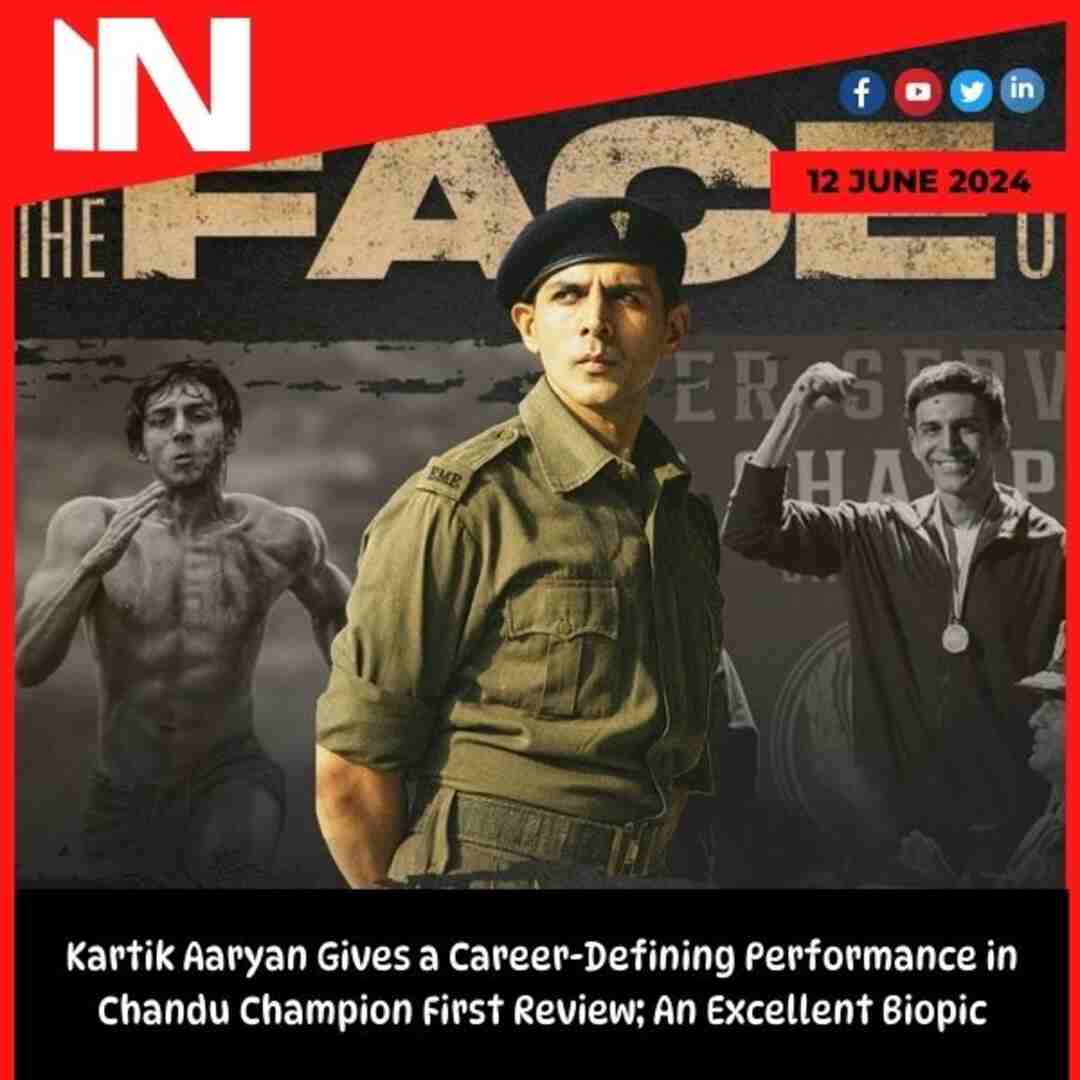

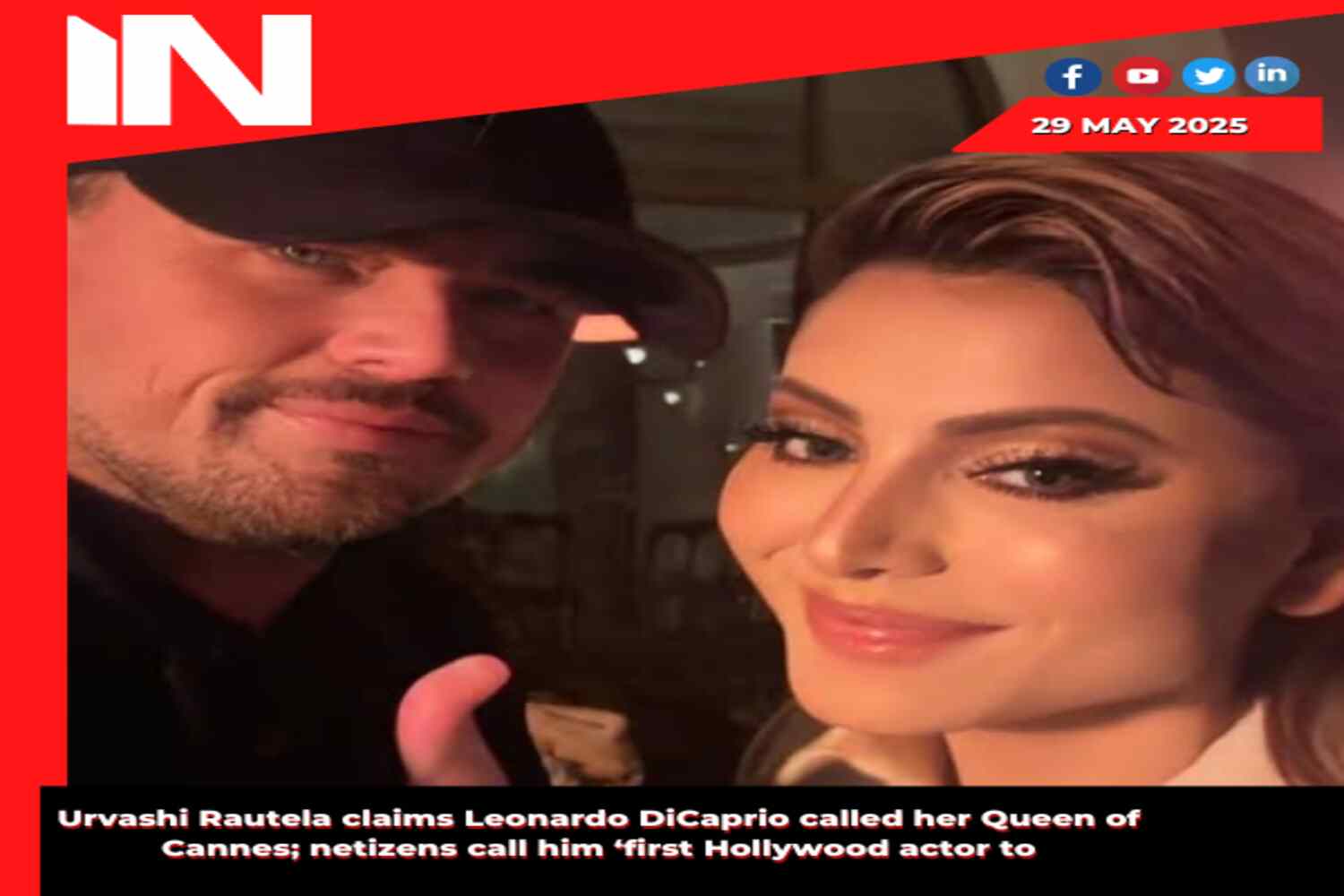

Celebrity News1 month ago

Celebrity News1 month agoAccording to Urvashi Rautela, Leonardo DiCaprio referred to her as the Queen of Cannes; online users refer to him as the “first Hollywood star to

-

Trending1 month ago

Trending1 month agoThug Life Movie Review & Release Live Updates: Kamal Haasan’s Bold New Venture – Is it the Hit We Expected?

-

Web Series1 month ago

Web Series1 month agoFirst impression of a good boy: Don’t let “Pouty” Park Bo Gum deceive you; he’s throwing punches of his career.

-

.png)

.png) Tollywood1 month ago

Tollywood1 month agoFour years after her divorce, did Samantha Ruth Prabhu get rid of her tattoo with the Naga Chaitanya link? Supporters are persuaded

-

Trending1 month ago

Trending1 month agoGauahar Khan criticises Suniel Shetty’s C-section remark, reveals she suffered a miscarriage: ‘For a male celebrity who didn’t go through pregnancy…’

-

%20(1).jpg)

%20(1).jpg) Hailee Steinfeld1 month ago

Hailee Steinfeld1 month agoActor Hailee Steinfeld marries Buffalo Bills quarterback Josh Allen in dreamy ceremony

-

.jpg)

.jpg) Hollywood4 weeks ago

Hollywood4 weeks agoStranded in Israel amid airstrikes, Caitlyn Jenner sips wine in bomb shelter and says, ‘Pray for us’

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)