Business

Sebi bars Anil Ambani, 3 others from markets for alleged siphoning of funds

SSC Exam Calendar 2025

SSC Exam Calendar 2025 revised, check CGL, CHSL, SI in Delhi Police, MTS, JE and other exam dates here

-

%20(2).jpg)

%20(2).jpg) Celebrity Lifestyle1 month ago

Celebrity Lifestyle1 month agoKareena Kapoor reveals her new schedule; says she has dinner at 6pm, lights out at 9:30 pm: ‘Saif, the kids and me, we’re all cooking together’

-

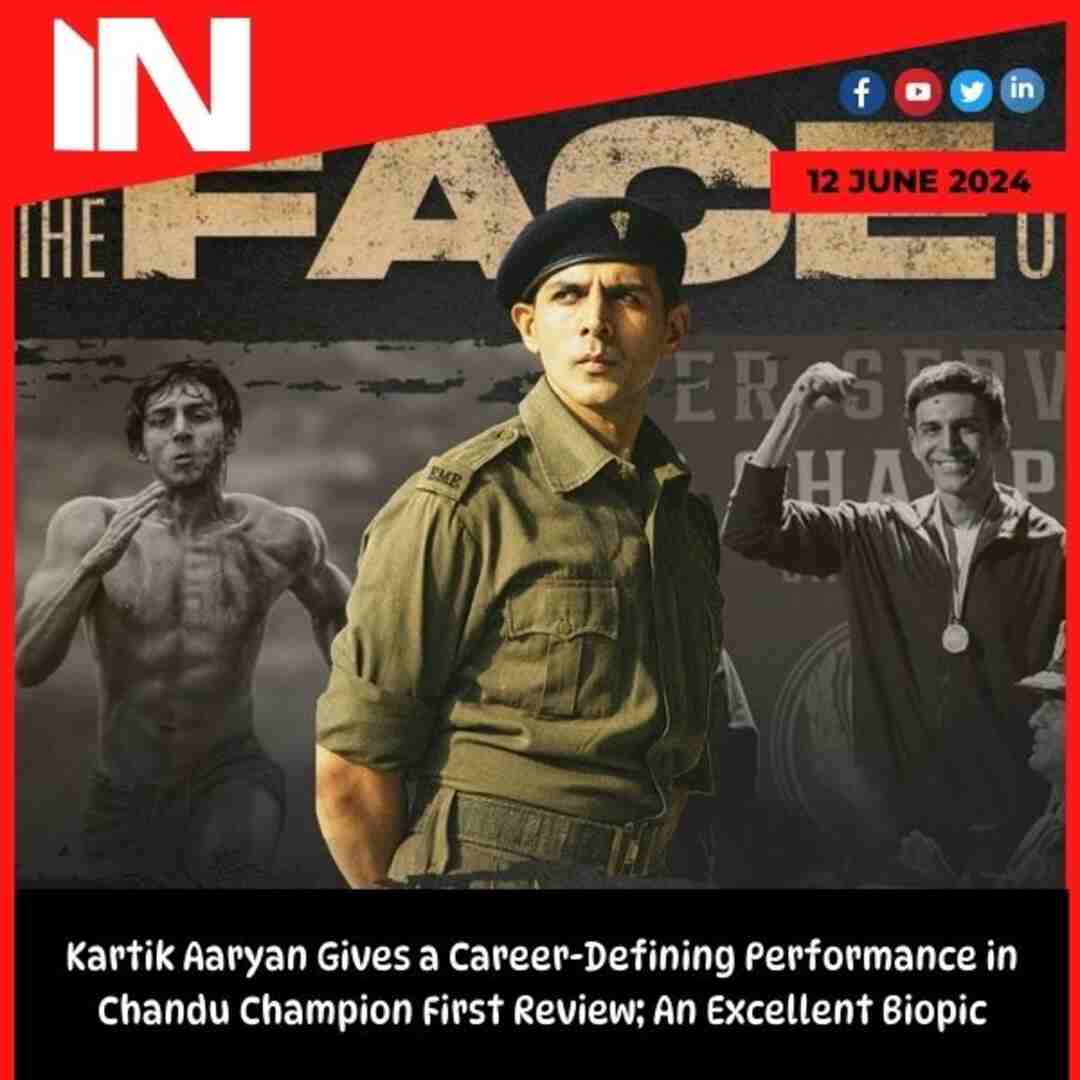

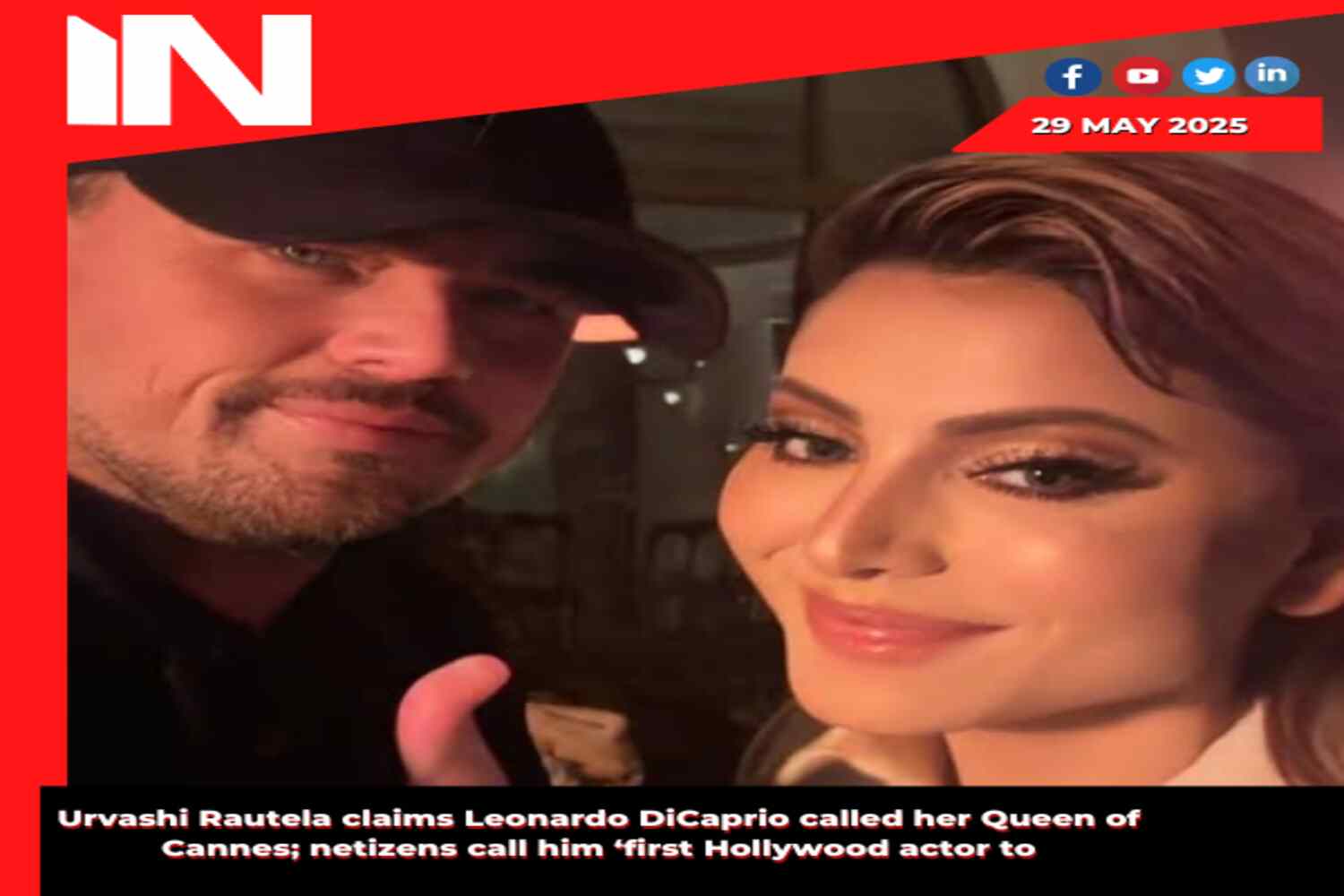

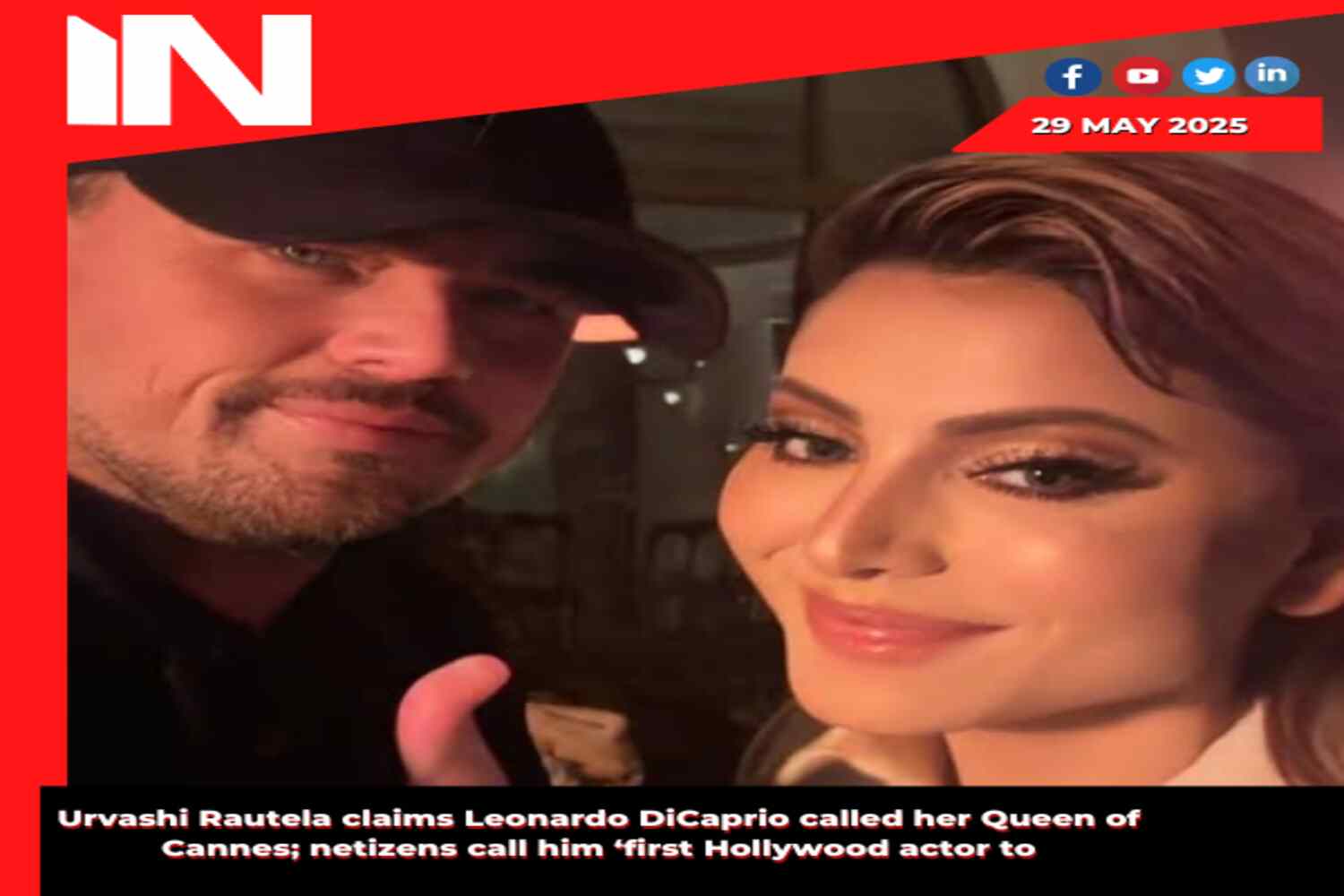

Celebrity News1 month ago

Celebrity News1 month agoAccording to Urvashi Rautela, Leonardo DiCaprio referred to her as the Queen of Cannes; online users refer to him as the “first Hollywood star to

-

Trending1 month ago

Trending1 month agoThug Life Movie Review & Release Live Updates: Kamal Haasan’s Bold New Venture – Is it the Hit We Expected?

-

Web Series1 month ago

Web Series1 month agoFirst impression of a good boy: Don’t let “Pouty” Park Bo Gum deceive you; he’s throwing punches of his career.

-

.png)

.png) Tollywood1 month ago

Tollywood1 month agoFour years after her divorce, did Samantha Ruth Prabhu get rid of her tattoo with the Naga Chaitanya link? Supporters are persuaded

-

Trending1 month ago

Trending1 month agoGauahar Khan criticises Suniel Shetty’s C-section remark, reveals she suffered a miscarriage: ‘For a male celebrity who didn’t go through pregnancy…’

-

%20(1).jpg)

%20(1).jpg) Hailee Steinfeld1 month ago

Hailee Steinfeld1 month agoActor Hailee Steinfeld marries Buffalo Bills quarterback Josh Allen in dreamy ceremony

-

.jpg)

.jpg) Hollywood4 weeks ago

Hollywood4 weeks agoStranded in Israel amid airstrikes, Caitlyn Jenner sips wine in bomb shelter and says, ‘Pray for us’

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)