Trending

15 Habits that could be hurting your business relationships

Et harum quidem rerum facilis est et expedita distinctio. Nam libero tempore, cum soluta nobis est eligendi.

Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt.

Et harum quidem rerum facilis est et expedita distinctio. Nam libero tempore, cum soluta nobis est eligendi optio cumque nihil impedit quo minus id quod maxime placeat facere possimus, omnis voluptas assumenda est, omnis dolor repellendus.

Nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

“Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat”

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem. Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam, nisi ut aliquid ex ea commodi consequatur.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi, id est laborum et dolorum fuga.

Quis autem vel eum iure reprehenderit qui in ea voluptate velit esse quam nihil molestiae consequatur, vel illum qui dolorem eum fugiat quo voluptas nulla pariatur.

Temporibus autem quibusdam et aut officiis debitis aut rerum necessitatibus saepe eveniet ut et voluptates repudiandae sint et molestiae non recusandae. Itaque earum rerum hic tenetur a sapiente delectus, ut aut reiciendis voluptatibus maiores alias consequatur aut perferendis doloribus asperiores repellat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Bollywood

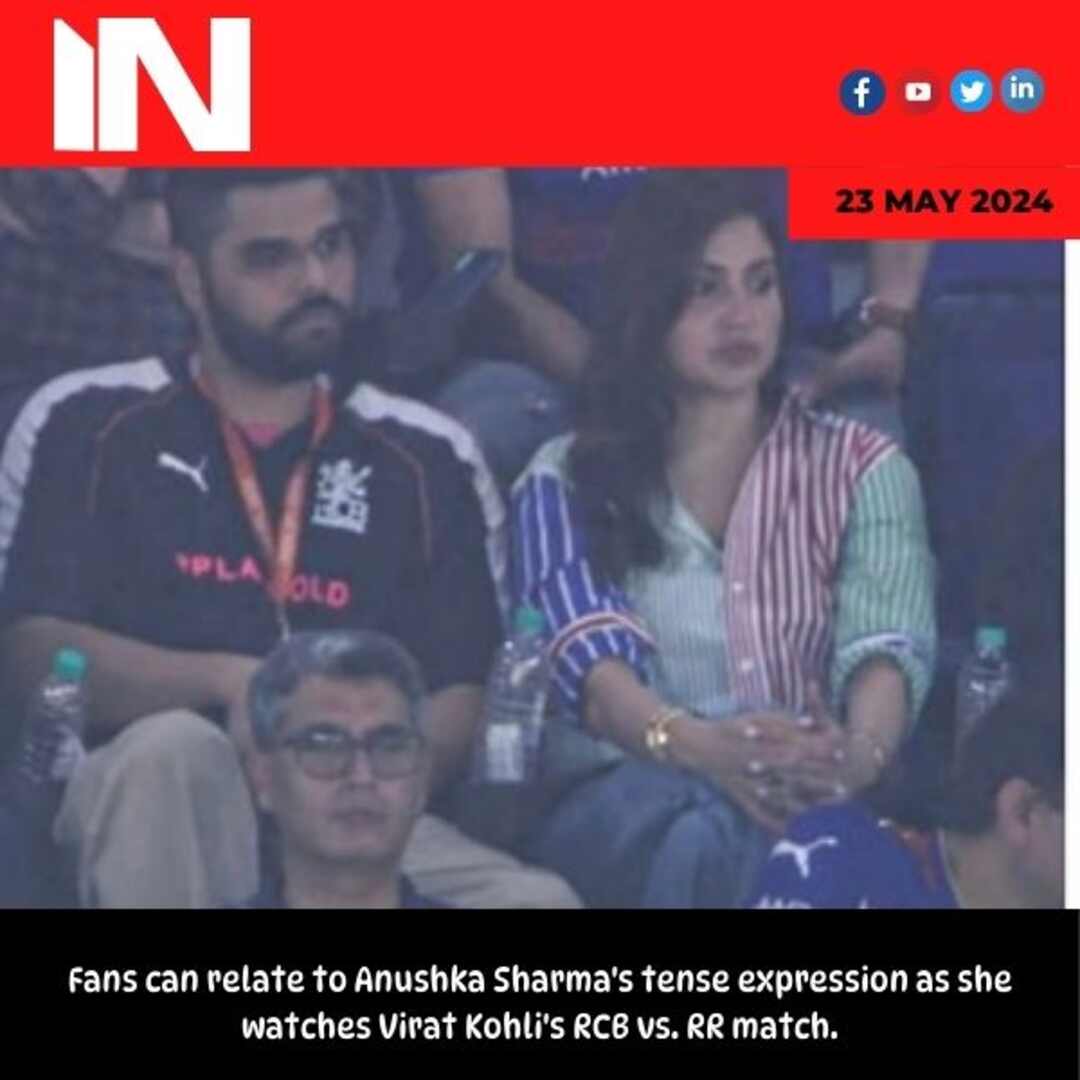

Fans can relate to Anushka Sharma’s tense expression as she watches Virat Kohli’s RCB vs. RR match.

Anushka Sharma was seen on Wednesday at the Narendra Modi Stadium in Ahmedabad cheering on her husband Virat Kohli’s Indian Premier League team, the Royal Challengers Bengaluru (RCB). In the IPL 2024 Eliminator, Rajasthan Royals (RR) defeated RCB. A video of the actress watching the match with a tense expression on her face is making the rounds on social media.

RCB is being supported by Anushka Sharma.

In response to Anushka’s tension-filled expression, RCB supporters and fans said they could identify with it. A fan of the RCB posted a video of Anushka from the stands on Instagram. The actor wore blue jeans and a striped shirt, and she had a serious expression on her face. She was talking with other RCB fans who appeared to be disappointed in the team’s defeat.

Responses to the video

“Presidential suite, amazing match, and Anushka Sharma right next to us!” the fan captioned the photo. Sad news, but we will always be there for RCB. From the greatest company to the best seats. RCB, onward and upward!”

Anushka’s video has received a lot of response on X and Instagram. The other wrote, “Heartbreak for the couple (Virat and Anushka).” A different individual stated, “Anushka looks upset as Virat Kohli’s RCB gets eliminated from IPL 2024.” “Every RCB fan can relate to Anushka right now,” another person remarked.

Anushka Sharma during a current RCB game

The actor has been a regular at recent RCB games. She gave birth to her second child, a son named Akaay, in February. She became Virat’s cheerleader during RCB’s victory over Delhi Capitals (DC) at the M Chinnaswamy Stadium in Bengaluru.

When DC’s last wicket was taken, Anushka Sharma’s joyous reaction was caught on camera. Anushka Sharma raised her hands in relief as well as leaping from her seat in the stands.

Anushka’s next film appearance will be as cricket player Jhulan Goswami in Chakda Xpress. Prosit Roy is the director of the sports film, which is produced by Karnesh Sharma, Anushka’s brother.

Group Media Publications

Entertainment News Platforms – anyflix.in

Construction Infrastructure and Mining News Platform – https://cimreviews.com/

General News Platform – https://ihtlive.com/

Podcast Platforms – https://anyfm.in

-

Web Series2 months ago

Web Series2 months agoSpoilers for Star Wars: The Acolyte, episode three: The new episode has caused the internet to go crazy.

-

Music2 months ago

Music2 months agoDalton Gomez, Ariana Grande’s ex, makes his Instagram debut alongside his new partner Maika Monroe.

-

Music2 months ago

Music2 months agoMin Hee-jin will continue to serve as ADOR’s CEO, and following the shareholders’ meeting, HYBE names three new board members.

-

Entertainment2 months ago

Entertainment2 months agoSawa Pontyjska, a Ukrainian model, is suing the Cannes Film Festival organisers, alleging that a security guard assaulted her on the red carpet.

-

Hollywood1 month ago

Hollywood1 month agoDeadpool and Wolverine might shatter box office records, which would be unprecedented for an R-rated film.

-

Entertainment2 months ago

Entertainment2 months agoKai Cenat, a Twitch celebrity, travels to Taiwan for this poignant occasion.

-

Hollywood2 months ago

Hollywood2 months agoMovie Review: ‘Am I OK?’ is a charming comedy about friendship that features Dakota Johnson’s endearing genuineness.

-

Music1 month ago

Music1 month agoBianca Censori’s obscene Tokyo ensemble provokes indignation in Japan. while Kanye West flies economy after losing…

.jpg)