Construction Infrastructure

REIT, Fractional Ownership in commercial real estate

Covid will be remembered as a watershed in human history and will have an indelible impact on our lives. Its impact on the future of real estate will be more centered on investment needs rather than end user needs. Covid will intensify the gradual change in real estate investment demand, which has been going on for some time due to the inherent dichotomy between the current real estate investment structure and the two key wealth management trends of digitalization and diversification.

Digitizing Now, technology is leading changes in consumer behavior. This effect is so common that for every rupee consumers spend or save today, a $1 billion startup is competing for its attention. The young population, their strong desire for relaxation, and the super entrepreneurial ecosystem will continue to push the boundaries of technology in all fields. In some respects, the pandemic has accelerated this digital adoption for at least five years, forcing companies to quickly develop strategies to stay relevant.

Unfortunately, the real estate industry has the slowest rate of digitization. For investors, the entire experience of buying and after-sales management is still a very stressful experience. Trust in technological infrastructure and one-click purchases may make the arduous real estate investment process no longer favored by many future investors for a period of time.

diversification Real estate accounts for 77% of the average wealth of Indian households, but HNWIs only allocate 30% of their wealth in real estate. The lower allocation of renewable energy to people with more disposable income suggests that investors tend to diversify their investment from renewable energy if they have a choice. Portfolio diversification is becoming more and more mainstream because it can generate better risk-adjusted returns and help achieve multiple investment goals. Affordability, liquidity and transparency are now key determinants of investment decisions.

Currently, real estate scores very low in all these areas. In fact, the huge financial obligations that must be undertaken by investing in real estate will squeeze out other investment opportunities from the investment portfolio. With the opening of various opportunities, this will inevitably have a negative impact on the future. In particular, non-traditional opportunities become within reach, making it easier to participate and exit.

There are global stocks, cryptocurrencies, P2P lending, funds, artworks, etc. Focus on commercial real estate As the uncertainty in the public stock and bond markets remains high, investors hope to hedge their risks by diversifying their portfolios through alternative investments. By definition, CRE is a property used for commercial purposes, whether it is an office, warehouse or retail store.

News Source : Construction Week Online

Construction Infrastructure

The Adani Enterprises unit has received a letter of approval for an NH project in Maharashtra

Adani Road Transport Ltd (ARTL), a wholly owned subsidiary of Adani Enterprises, has received LoA for a project involving six laning of Kagal-Satara section of NH-48 (old NH4) in Maharashtra. The project will be executed under the Bharatmala Pariyojana at ₹2,008.47 crores. The construction period for the 67-km long road project is expected to be 2 years from the date of appointment and the concession period will be 18 years.

With this project award, Adani’s road portfolio will have total 14 projects with more than 5,000 lane km with asset value exceeding ₹41,000 crore spread across India.

-

Bollywood2 months ago

Bollywood2 months agoAishwarya Rai maintains her stunning appearance in a new L’Oreal ad.

-

health and remedies2 months ago

health and remedies2 months agoThe article discusses the potential health risks associated with swallowing dry ice

-

.jpg)

.jpg) Music1 month ago

Music1 month agoSidhu Moosewala’s father and baby brother feature on Times Square billboard; fans react. Watch

-

Bollywood3 weeks ago

Rasha, the daughter of Raveena Tandon, discusses how trolling affects her: “I think in processing it, feeling bad for a bit.”

-

Entertainment2 months ago

Entertainment2 months agoThe Anant Ambani-Radhika Merchant pre-wedding bash in Jamnagar has received a list of guests.

-

Trending2 months ago

Trending2 months agoDolly Chaiwala: “Didn’t Know Who He Was” in reference to giving Bill Gates tea

-

Bollywood4 weeks ago

Bollywood4 weeks agoThe phrase “female-led projects” annoys Bhumi Pednekar. “It disgusts me deeply.”

-

Bollywood2 months ago

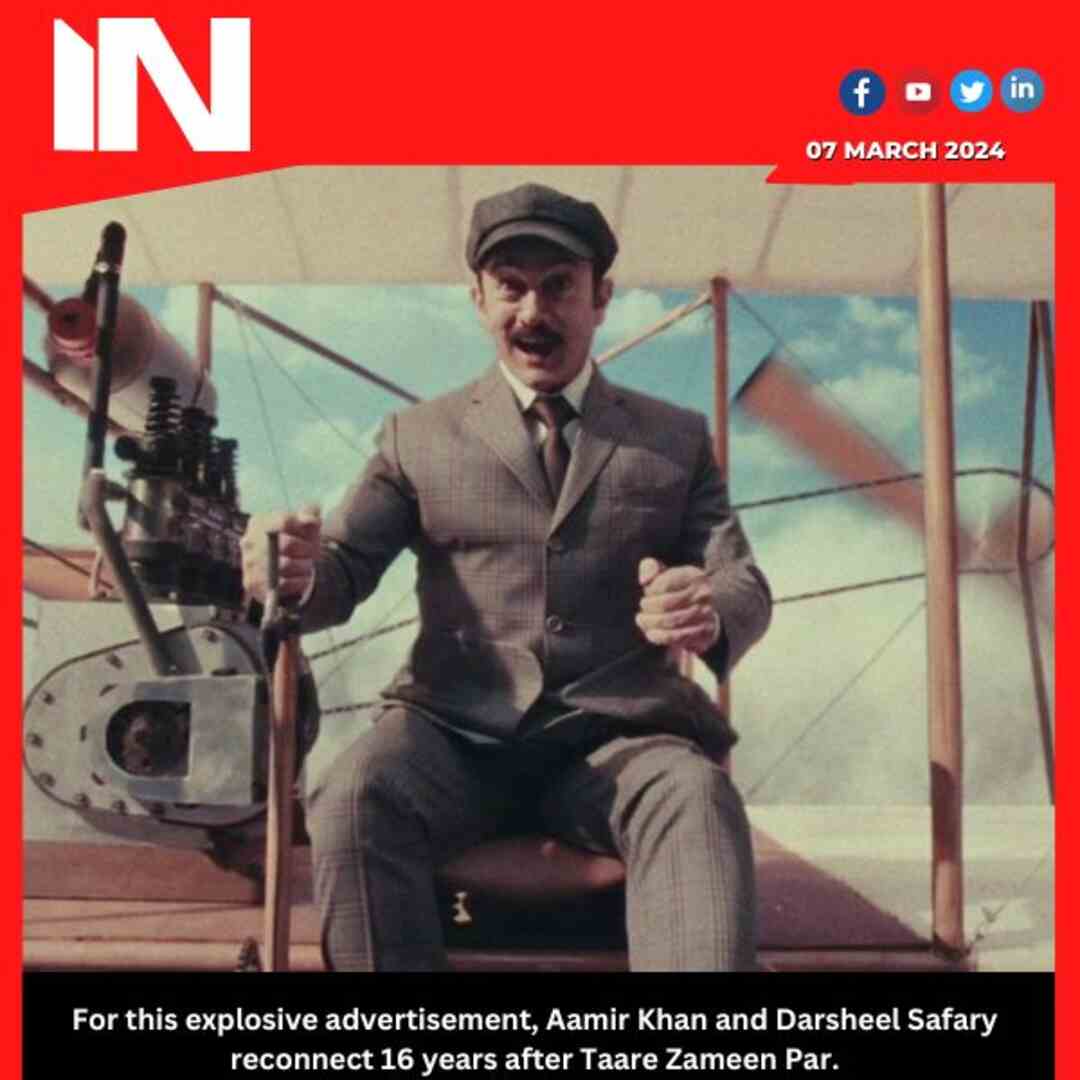

Bollywood2 months agoFor this explosive advertisement, Aamir Khan and Darsheel Safary reconnect 16 years after Taare Zameen Par

.jpg)