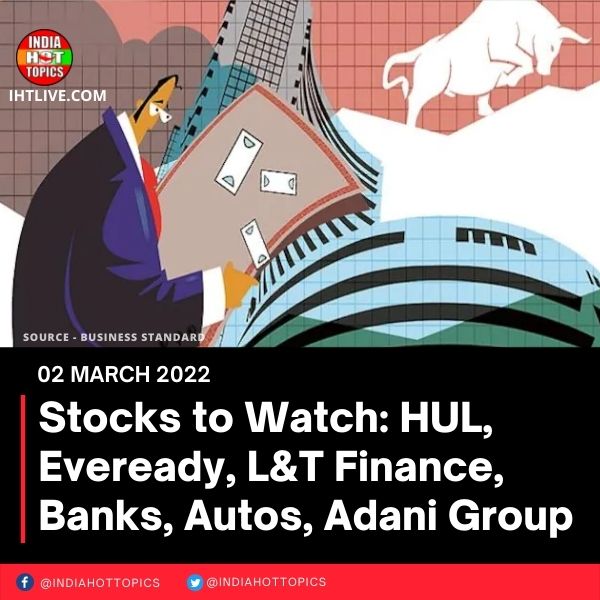

The key benchmark indices are likely to start trade on Wednesday with losses in excess of a per cent each taking cues from the global markets turmoil amidst the ongoing Russia- Ukraine conflict and record high oil prices. As of 07:55 AM, the SGX Nifty March futures quoted at 16,488 – indicating a gap down of nearly 300 points when compared with Monday’s close. Meanwhile, here are the stocks to focus in trade today.

Banks: In the backdrop of the ongoing Russian invasion of Ukraine and the West imposing tough sanctions on Russia, the Reserve Bank of India (RBI) is also gauging the extent of damage to the Indian banking sector due to the worsening geopolitical situation. The Indian Banks’ Association (IBA) called a meeting with top banks of the country on Monday, and asked them to submit detailed information on their exposure to both Russia and Ukraine by Wednesday.

Car makers: Maruti Suzuki India (MSI) said its domestic sales slipped 8.46 per cent to 1,40,035 units as against 1,52,983 units in February 2021. Meanwhile, Tata Motors and Mahindra & Mahindra reported an increase in wholesales in February. The former reported a 47 per cent increase in passenger vehicle sales, while the latter sales soared by 80 per cent on a YoY basis last month.

Hero MotoCorp: The two-wheeler major reported 29.1 per cent YoY drop in sales to 358,254 units, even as exports jumped 27.4 per cent to 26,792 units in February.

TVS Motors: The company’s vehicle sales declined by 5.4 per cent in February 2022 at 281,714 units when compared with 297,747 units in February 2021. Exports were up 6 per cent YoY at 101,789 units.

Eicher Motors: Motors: Total monthly sales dropped 15 per cent on a YoY basis in February 2022 to 59,160, while exports jumped 55 per cent YoY to 7,025 units.

Hindustan Unilever (HUL): The FMCG major hiked prices across its portfolio of products by 3-13 per cent in multiple tranches in February, with the sharpest increase of 13 per cent seen in the 100 gm Lux soap pack, the price of which increased to Rs 35 from Rs 31 earlier.

L&T Finance Holding (LTFH): The groundwork for making L&T Finance Holding (LTFH) a retail credit-driven entity had begun before Larsen & Toubro (L&T), its parent, said its subsidiary would get out of wholesale and real estate funding. The company has articulated a roadmap to grow the share of retail loans from 50 per cent to 80 per cent by March 2026.

Eveready: The Burman family – promoters of Dabur India – will look at appointing “Key Management People” in the country’s largest dry cell battery maker, Eveready Industries India, post completion of the open offer. Amritanshu Khaitan term as the managing director ends in May 2022.

On Monday, Dabur India announced an open offer for acquiring 26 per cent stake in Eveready. The open offer was priced at Rs 320 per share aggregating to a total consideration of up to Rs 605 crore. The stock last traded at Rs 376.35 on the Bombay Stock Exchange on Monday.

Adani Group: The Group announced its foray into media business, on entering into a binding term sheet to acquire a minority stake in Quintillion Business Media Private Limited. With this move, Adani is set to face off with Reliance which owns India’s Network18 that runs several business TV news channels and online platforms.

Tata Steel: The steel major is looking to set up a ‘world class’ facility to produce medical material and as a step towards it, Tata Steel Advanced Materials (TSAML), an indirect wholly-owned subsidiary, has invested in a bio-ceramics startup for acquiring 90 per cent stakte in Ceramat Private Limited.

Piramal Enterprises: The company’s board approved a proposal to raise up to Rs 500 crore through issue of non-convertible debentures on a private placement basis.

Complete news Source : Business Standard

Ranbir Kapoor2 months ago

Ranbir Kapoor2 months ago

Mahakumbh2 months ago

Mahakumbh2 months ago

American Dream1 month ago

American Dream1 month ago.jpg)

.jpg) Bollywood1 month ago

Bollywood1 month ago

Sunny Leone2 months ago

Sunny Leone2 months ago

SSC Exam Calendar 20251 month ago

SSC Exam Calendar 20251 month ago

Parineeti Chopra2 months ago

Parineeti Chopra2 months ago

Ajith Kumar2 months ago

Ajith Kumar2 months ago

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpg)

%20(2).jpg)

%20(1).jpg)

.jpg)