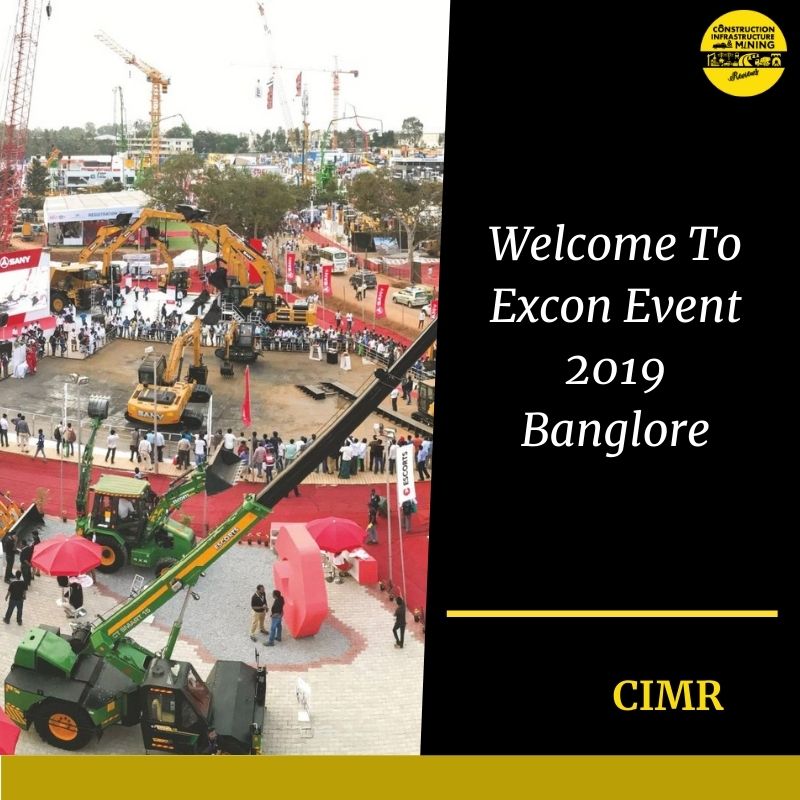

Excon Events is The Market Place For Construction Equipment Industry

The infrastructure part is a key driver for the Indian

economy. The segment is exceptionally liable for pushing India’s general

improvement and appreciates serious concentration from the Government for

starting strategies that would guarantee the time-bound formation of

world-class infrastructure in the nation. The infrastructure division

incorporates control, spans, dams, streets and urban infrastructure

advancement.

The Indian economy is right now around Rs 190 lakh crore (GDP at current market costs, 2018-19) which turns out to be $2.8 trillion, changing over it in dollar terms taking the normal swapping scale of the money related year.

The portrayal of the Indian economy, anticipating the nation’s (GDP) would develop at 7% in 2019-20, against a five-year low of 6.8 percent the former year. This low in GDP was with political security encouraging a get sought after and speculations. India would need to develop at 8 percent yearly to turn into a $5-trillion economy by FY25, the overview venture.

INDIA’S SUSTAINABLE DEVELOPMENT REQUIRES INVESTMENT WORTH OF

RS 50 TRILLION (US $ 777.73 BILLION)

IN INFRASTRUCTURE BY 2022 In Excon

1. India has a necessity of venture worth Rs 50 trillion

(US$ 777.73 billion) in infrastructure by 2022 to have manageable advancement

in the nation.

2. In the Union Budget 2019-20, the Government of India has

given a huge push to the infrastructure segment by apportioning Rs 4.56 lakh

crore (US$ 63.20 billion) for the part.

3. FDI got in the Construction Development part (townships,

lodging, developed infrastructure, and development improvement ventures) from

April 2000 to December 2018 remained at US$ 24.91 billion and in Construction

(Infrastructure) exercises remained at US$ 14.01 billion.

4. With activities like ‘Lodging for All’ and ‘Brilliant Cities Mission,’ the Government of India is taking a shot at lessening bottlenecks and hindering development in the infrastructure sector.Rs 2.05 lakh crore (US$ 31.81 billion) will be put resources into the keen urban communities crucial. Every one of the 100 urban communities has been chosen as of June 2018.

5. In Union Budget 2019-20, Rs 83,015.97 crore (US$ 11.51 billion) was apportioned for National Highways Authority of India (NHAI) while Rs 19,000 crore (US$ 2.63 billion) was designated to Pradhan Mantri Gram Sadak Yojana (PMGSY) for improvement of streets in provincial and in reverse territories of the nation.

6. The Indian Railways got a designation under Union Budget 2019-20 at Rs 66.77 billion (US$ 9.25 billion). Out of this allotment, Rs 64.587 billion (US$ 8.95 billion) is capital used.

7. Indian Railways will require a venture of Rs 35.3 trillion (US$ 545.26 billion) by 2032 to limit expansion and modernization. Capital consumption in the division is required to be expanded by 92 percent every year.

8. For 2019-20, the absolute capital use of Railways is

relied upon to be Rs 1.59 trillion (US$ 22.04 billion).

9. In the 2019-20 Union Budget, the administration reported

Rs 83.02 billion (US$ 11.51 billion)for street transport and parkway.

10. The Government of India will develop 65,000 km of

thruways by 2022.

11. The administration declared designs to put US$ 6.98

billion in the Northeast States.

12. The Airports Authority of India intends to bring around

250 air terminals under activity the nation over by 2020.

13. The AAI plans to spend over Rs 21,000 crore (US$ 3.2

billion) between 2018-22 to assemble another terminal and grow the limit of

existing ones.

14. Metro rail ventures worth over Rs 500 billion ($7.7

billion) are in progress in India and this heap will most likely develop.

Occasion Fact Sheet

1. Biggest CONSTRUCTION EQUIPMENT EXHIBITION IN SOUTH ASIA

2. 3,00,000 SQ.MTS OF EXHIBITION DISPLAY AREA

3. UFI APPROVED EVENT

4. 1250+ EXHIBITORS INCLUDING 350 FROM ABROAD

5. 10 COUNTRY PAVILIONS

6. BUSINESS VISITORS

7. Item LAUNCHES

8. INDUSTRY CONFERENCES BY CII, BAI, AND ICEMA

Ranbir Kapoor3 weeks ago

Ranbir Kapoor3 weeks ago

Sunny Leone2 weeks ago

Sunny Leone2 weeks ago

Mahakumbh2 weeks ago

Mahakumbh2 weeks ago

Parineeti Chopra3 weeks ago

Parineeti Chopra3 weeks ago

Pahalgam Attack2 weeks ago

Pahalgam Attack2 weeks ago

American Dream5 days ago

American Dream5 days ago

UP Board Result 20252 weeks ago

UP Board Result 20252 weeks ago

Trending3 weeks ago

Trending3 weeks ago

.1.jpg)

.jpg)